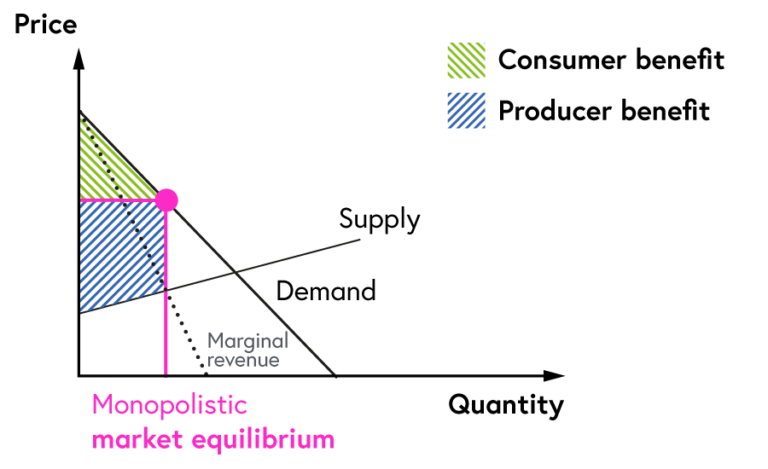

Home / Nature & Environment / Climate Change / Exploring Possible Futures: Modeling in Environmental and Energy Economics / Monopoly model: the mathematics II

This article is from the free online

Exploring Possible Futures: Modeling in Environmental and Energy Economics

Reach your personal and professional goals

Unlock access to hundreds of expert online courses and degrees from top universities and educators to gain accredited qualifications and professional CV-building certificates.

Join over 18 million learners to launch, switch or build upon your career, all at your own pace, across a wide range of topic areas.