This page is from the online course:

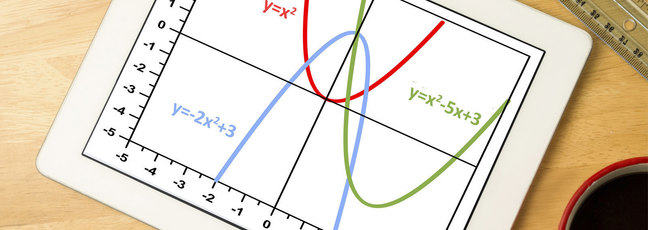

Maths for Humans: Linear, Quadratic & Inverse Relations

UNSW Sydney

Why FutureLearn?

Learn anything

Whether you want to develop as a professional or discover a new hobby, there's an online course for that. You can even take your learning further with online microcredentials and degrees.

Learn together

Join millions of people from around the world learning together. Online learning is as easy and natural as chatting with a group of friends.

Learn with experts

Meet educators from top universities and cultural institutions, who'll share their experience through videos, articles, quizzes and discussions.