What could Brexit mean for tax?

In this post Alberto Asquer, lead educator on Understanding Public Financial Management, discusses tax in light of the UK leaving the EU.

In this post Alberto Asquer, lead educator on Understanding Public Financial Management, discusses tax in light of the UK leaving the EU.

As the New Year gets underway the direction the UK will take when leaving the European Union is slowly becoming clear. Despite contrasting views about the advantages and disadvantages of a “hard” or “soft” Brexit, Theresa May yesterday made clear a push for “hard brexit”. So, with an exit to the free market seeming inevitable, the common consensus is that the UK should persist to make the domestic environment business friendly through measures that include, among others, a highly competitive tax regime.

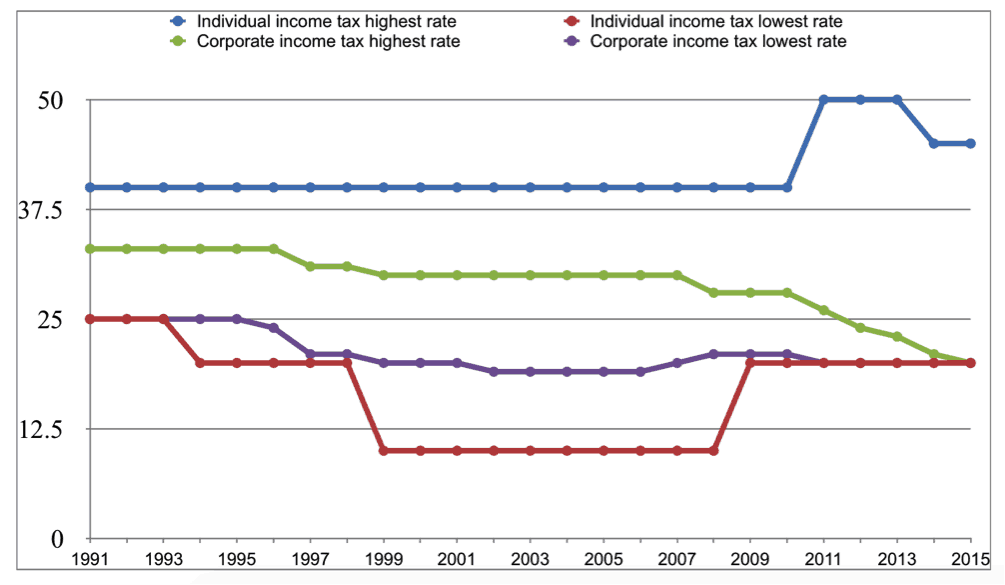

During recent years, the UK has become an increasingly attractive business environment, also for tax reasons. The picture below shows the trend of the highest and lowest personal income rates (excluding the zero tax rate) and of the highest and lowest corporate income rates (where the lowest rate is applied to small companies). At present, corporate income tax rate is 20%, and it is expected to fall to 19% for the year beginning 1 April 2017, and to 17% for the year beginning 1 April 2020. These rates are considerably lower than those applied in the other main EU economies, like Germany, France, and Italy, where corporate income rates exceed 30% (and total corporate income taxes, when also counting, for example, social security and sub-national income tax rates, may exceed 60% of profit). Some smaller EU economies, however, pursue a low corporate income tax policy, for example in Estonia (a 20% tax on distributed profits) and Ireland (12.5%).

Relatively low corporate income tax rates is one example of what’s known as ‘tax competition’, where countries pursue the enlargement of their tax base (ie. the amount of income that can be taxed) at the expense of other countries. Apart from cutting tax rates, tax competition can take other forms, for example providing tax deductions, tax holidays (eg no taxation for foreign direct investments), and administrative measures like the simplification of tax compliance.

But are there any benefits? On the one hand, tax competition is regarded as a harmful practice because it erodes the tax bases of countries where economic activity originally prospered. Tax competition also makes it harder for a country with a relatively large public sector to keep sustaining it, especially if taxpayers leave for other countries with more advantageous tax regimes. On the other hand, tax competition is also considered as a positive – if not a naturally emergent – feature of the world economic system. The mechanism helps keep profligacy in public spending and inefficient public bureaucracies in check, because taxpayers would relocate to other countries where the tax bill is commensurate with the level and quality of public services.

Want to find out more about tax policies? Do you wonder about the effects of tax policy decisions on the management of public finances in your country? Join Understanding Public Financial Management: How is Your Money Spent?