How do pensions work? Calculating how much money you need to retire

No matter your age, it’s never a bad time to think about retirement. Here, we look at how pensions work, when you can retire, and how much you’ll need to retire.

Although pensions and saving for the future aren’t often discussed, they should be. Making informed financial decisions early in your career can be hugely beneficial when it comes to retirement age. But how do pensions work? And how much do you need to retire?

We explore some of the key mechanics behind pensions and retirement in the UK, looking at state pensions, retirement ages, and how much you’ll need to live certain lifestyles.

During a time of increasing living costs, it can be difficult to think about saving money, especially as everyone’s circumstances are different. However, there is never a bad time to think about the future.

It’s important to note that we are not offering financial advice of any kind. We’re covering key terms and concepts to help you get started. For investment decisions and advice, seek the help of a professional.

What is a pension?

A pension is a type of financial fund into which money is added for your retirement, allowing you to draw payments from it once you stop working. There are various financial products that let you save for your retirement individually, as well as employer- and state-funded options.

Pensions give savers the opportunity to make a long-term investment, as well as take advantage of certain tax laws. Many pensions give you the freedom to choose how your funds are invested, usually in stocks and shares. However, there are certain limits on how much you can pay into a pension.

The word pension comes from the latin word pensioun, which means ‘payment for services’, especially when in the form of a regular reward or annual payment.

Understanding investments such as pensions is an important skill no matter what stage of life you’re at. With a bit of knowledge, it’s easy to make your money work harder for you.

Types of pensions

In the UK, there are three main types of pensions:

- Defined contribution pension. This is perhaps the most common type, known often as a ‘pension pot.’ Money is paid in by you and/or your employer and is invested by the pension provider. How much you get when you retire depends on how much is paid in and how well the investment has performed.

- Defined benefit pension. Although less popular now, this was a popular choice for a long time. It was also known as a ‘final salary’ or ‘career average’ pension, whereby you’d get a guaranteed annual pension when you retire. The amount depended on your earnings, how long you’d worked for an employer, and your individual terms.

- State pension. This is money provided by the government when you reach the state pension age. The amount you’ll get depends on your current age, as well as your work history and National Insurance contributions throughout your career.

How do pensions work?

The main mechanic behind pensions seems pretty straightforward. Money is regularly put aside and invested to grow over many years, and when you retire, you get a regular income once you’re no longer earning. However, there are a fair few intricacies, depending on the type of pension. Let’s look at each in a bit more detail:

State pension

When a person in the UK retires, they are entitled to an income from the state, providing they meet certain criteria. First, they must be at the state pension age (currently 66 years old, although due to increase).

Secondly, they need at least 10 years’ worth of National Insurance contributions to receive any pension, and 35 years’ worth to receive the full amount. These contributions are made automatically when you’re working, and there are ways to plug the gaps for when you’re not.

Workplace pensions

As we’ll see, the state pension amount probably won’t provide all of your income for retirement. Consequently, most people will also have a pension with their employer. These types of pensions take money from you, your employer, and the government and invest them in various ways.

Usually, your contribution is taken as a percentage of your monthly salary, and quite often your employer will match it up to a certain percentage. This matched contribution is essentially free money, so it can be prudent to maximise how much your employer will match.

Personal pensions

A personal pension is (as the name suggests) a pension you arrange yourself. Similar to a workplace pension, it’s usually a defined contribution setup, with a view to growing your money over time.

This type of pension is a smart choice for the self-employed, but anyone can set up and save into such a scheme.

Pension tax relief

One of the main benefits of paying into a work or personal pension is that you get tax relief on your money. This means that some of your money that would have been paid in tax to the government instead goes into your pension. Again, when combined with employer contributions, you can soon start growing your pension pot on multiple fronts.

How much is the state pension?

The exact amount of pension you’ll receive depends on several factors. For those reaching state pension age on or after April 6 2016, the full level of pension is currently £179.60 a week for 2021-22. This works out at just over £9,350 a year. However, you’ll need to have made 35 years of National Insurance contributions to receive this amount and at least 10 years’ worth to get anything.

This state pension amount applies to women born on or after April 6 1953, and men born on or after April 6 1951.

What is the pensions triple lock?

The triple lock is a measure that was put in place to guarantee that state pension amounts will rise in line with one of three measures of growth. Whichever is greatest between the average earnings growth, consumer price index (measuring inflation) or 2.5%, will be the rate the state pension increases by.

However, due to the fallout from the pandemic and distorted wage growth figures, the government switched to a double lock system.

When will you get a state pension?

Again, a few factors affect the age at which you’ll receive your pension from the government. Currently, the age at which both men and women can claim their state pension is 66.

However, the state pension age is due to rise to 67 between 2026 and 2028. What’s more, it’s set to rise further, to 68, between 2037 and 2039. If you’re unsure when you’ll be eligible to retire in the UK, you can check on the government’s pension age calculator.

What is early retirement?

Of course, just because your state pension isn’t claimable until you’re in your mid-to-late-sixties doesn’t mean you have to work that long. Many private pensions allow you to claim your savings as an income from the age of 55 (rising to 57 from 2028). However, this depends on how much you have saved and how long you’ve been saving for. Remember, once you fully retire, you won’t have any income from work anymore.

If you were to retire at 55, you would have to wait a further 11-13 years before you receive your state pension. This means you’ll have to rely solely on the money you’ve saved in your private pension until state pension age unless you continue working during that time.

How much do you need to retire?

When it comes to considering how pensions work, it’s worth considering the type of lifestyle you hope to live once you finish work forever. Although it might seem like a very long time away, especially if you’re just starting your career, the decisions you make now could impact you further down the road.

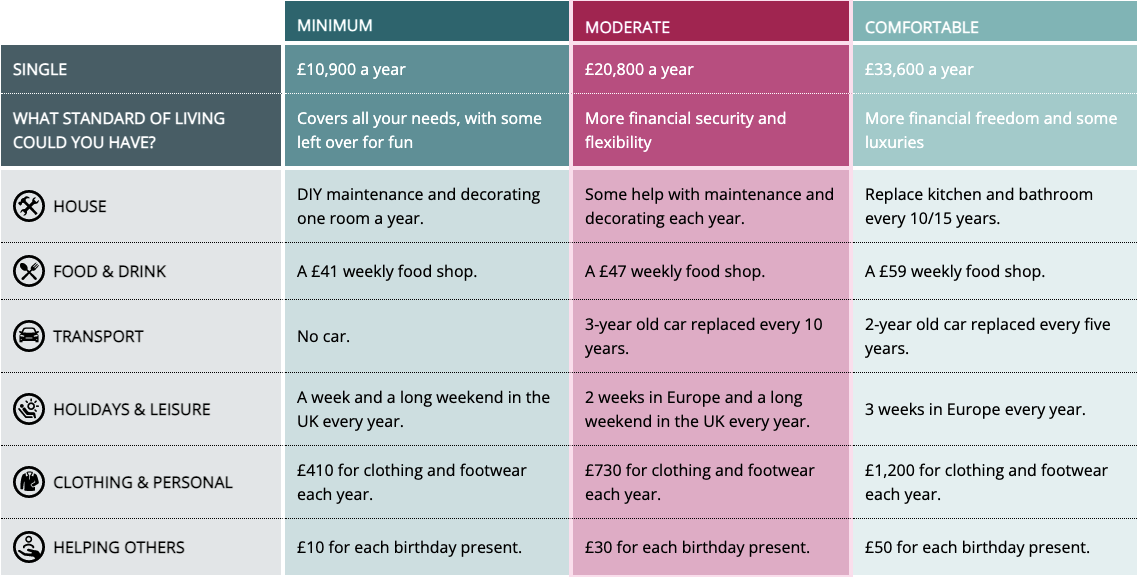

To give an idea of your retirement lifestyle, experts generally tend to break them down into three levels. The exact figures on how much you’ll need to retire vary between sources, and in 30 years’ time, these figures could look very different depending on factors like inflation.

However, recent figures from the Pensions and Lifetime Savings Association (PLSA) show the following levels, based on figures for someone living outside of London:

Minimum

For a single person, you’ll need £10,900 per year or for a couple, £16,700. This level covers all of your basic needs with a small amount left over for things like a UK holiday each year and eating out once a month.

Moderate

For extra financial security, you’ll need £20,800 per year as a single person or £30,600 as a couple. At this level, you could afford a foreign holiday in the year, as well as more leisure activities each month.

Comfortable

To have a more luxurious lifestyle and more financial freedom, you’ll need a pension total of £33,600 per year as a single person or £49,700 as a couple. With this amount, you’ll have much more flexibility with money, and be able to afford more holidays and leisure activities.

So how much do I need to retire?

As you can see, based on those levels, even a full state pension doesn’t quite cover the minimum you’ll need. This is why understanding the basics of wealth management and how to do basic accounting becomes so important. Planning your finances for the future is essential, particularly if you want to retire in relative comfort.

When it comes to how much you’ll actually need to retire, there are several things to consider. Many sources suggest that you’ll need two-thirds of your working salary in annual pension payments. The average UK wage is around £27,000, so you’d need around £18,000 in pension payments each year if this is what you’re currently earning.

Other factors include:

- When you want to retire

- How much you currently have saved

- How old you currently are

- The growth of your investment over time

- Whether you take a tax-free payment when you retire

- Interest rates and inflation when you retire

- Any future changes to tax or pension rules

How much should be in my pension pot?

The average UK pension pot after a lifetime of saving is around £61,897. With the financial situation how it is right now, this would give you roughly £3,000 per year from the age of 67 (and you’d also get your state pension, don’t forget). Combined, this would give an annual income of just over £12,000.

Let’s go back to our three levels for a single person and see how much you’d need in a pension pot to achieve such levels. According to some experts, you’ll need around 20-25 times your retirement expenses in your pension when you retire. Let’s see how this calculates once we’ve deducted the £9,350 per year given by the current state pension:

- Minimum. To make up the extra income from the state pension to the minimum level, you’ll need to have a pension pot of £31,000 – £38,750 when you retire.

- Moderate. To bridge the difference at this level, you’ll need £229,000 – £286,250 in your pension pot.

- Comfortable. To have a luxurious retirement, you’ll need between £485,000 – £606,250 in your pension pot when you retire.

Although those numbers may seem eye-wateringly high for many, don’t forget that there are many factors at play here. It all depends on the lifestyle you want to live, the amount you already have saved and how quickly it grows (or doesn’t), how much you’re able to save between now and retirement, other sources of income, and many other variables.

What’s clear is that it’s important to understand how money works and how it can affect you, both now and in the future. As an ageing population, it’s important that we’re well-positioned to enjoy our senior years. What’s more, understanding how investments work can help both in your career and in your personal life.

Useful resources

If you’re looking for more information about your future, both financial and general, we have a range of courses and resources available.

Courses:

- Why Do We Age? – University of Gronigen

- Healthy Ageing – University of Birmingham

- History of Finance and Stock Market – University of Southampton

- Understanding Public Financial Management – SOAS University of London

- Decentralised Finance: Ethereum, and The Future of Banking – RMIT University

- Risk Management in the Global Economy – SOAS University of London

- Impact Investing – JSiE and Asha Impact

Blog posts:

Pension FAQs

Let’s look at some of the questions that frequently come up around pensions and retirement. Remember, if you need advice on your finances or savings, consult a professional. We are not here to provide financial advice of any kind.

Can I take my pension and still work?

In short, yes. For example, you could take your private pension at 55 and carry on working for as long as you like.

How much pension is tax-free?

20% tax relief is automatically applied to pension contributions you make or contributions taken directly from your salary by an employer. Similarly, any gains you make from a pension investment can usually be enjoyed tax-free.

How much can I pay into my pension?

In the UK, there is no limit to how much you can contribute into your pension. However, there is a limit on how much tax relief you’ll receive. The current cap is at £40,000 per year.

What is FIRE?

The levels of saving required for retirement can seem daunting at first. As more people start to think about their financial futures, there are some interesting movements occurring. One such movement that has gained a fair amount of attention is the FIRE method.

The acronym stands for Financial Independence, Retire Early and it focuses on extreme investments and frugality early in life, giving people the chance (or hope) to retire early and in comfort.

Inspired by a 1992 book called Your Money or Your Life, advocates of the movement dedicate the majority of their income (as much as 70%) to their savings, hoping the annual growth will give them enough to retire on far below the state pension retirement age.